In today's global economy, managing payroll across multiple jurisdictions has become increasingly common. However, with this opportunity comes the challenge of maintaining compliance with various regulatory frameworks.

Compliance isn't just about following rules—it's about building trust with your employees and protecting your business from potential risks.

Understanding Multi-Jurisdiction Compliance

Each jurisdiction has its own set of rules and regulations governing payroll. These can include different tax rates, reporting requirements, payment schedules, and employee classifications. Understanding these differences is crucial for maintaining compliance.

Key Compliance Challenges

Tax Calculations

Managing different tax rates and requirements across jurisdictions.

Reporting Requirements

Meeting various filing deadlines and documentation standards.

Currency Management

Handling multiple currencies and exchange rate fluctuations.

Data Privacy

Ensuring compliance with data protection regulations in each jurisdiction.

Best Practices for Compliance

Implement robust systems and processes that can adapt to changing regulations. Regular audits and updates ensure continued compliance across all jurisdictions.

The key to successful multi-jurisdiction payroll is having systems that can automatically adapt to different regulatory requirements while maintaining accuracy and efficiency.

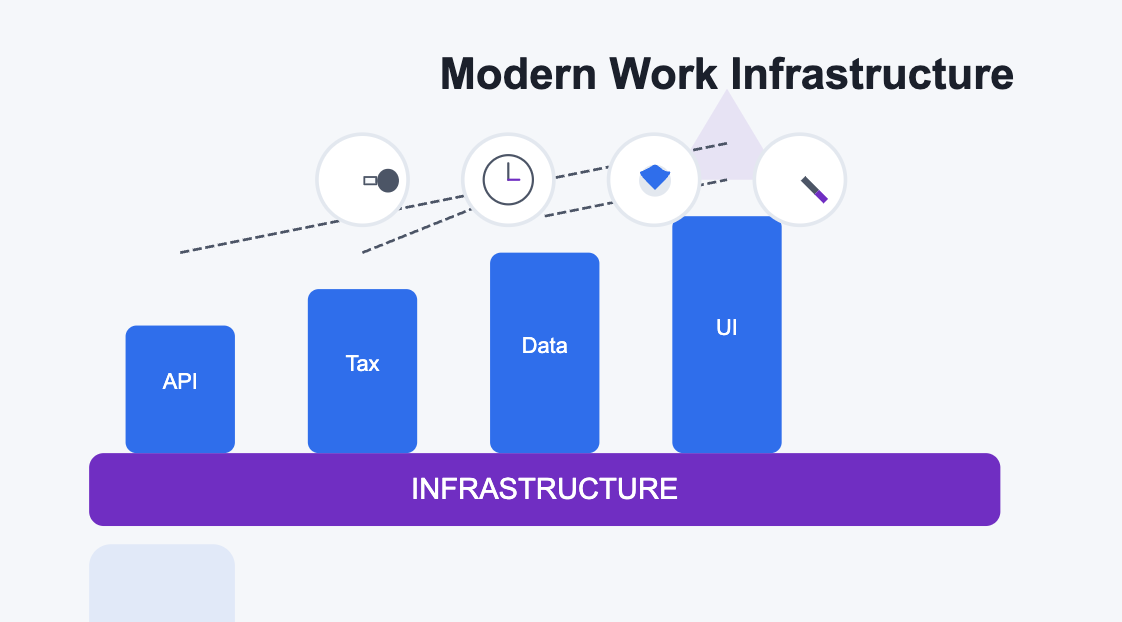

With the right infrastructure in place, managing payroll across multiple jurisdictions doesn't have to be overwhelming. Modern solutions can automate much of the compliance work, reducing risk and saving time.

Learn how Payflo can help you maintain compliance while processing payroll across multiple jurisdictions. Our platform is designed to handle the complexities of global payroll, so you can focus on growing your business.